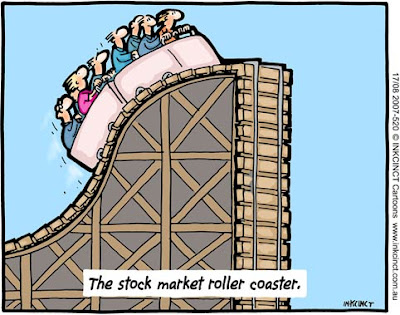

So if you know you are skeptical to lend because the loan may default due to the inability of the debtor to pay back then what is the logical conclusion in these economic times? Their conclusion is not to lend because of fear of the loan defaulting. But when the banks do not lend they will not make any money and thus you have what happened today the stock market takes a dive with the financial sector leading the way (notwithstanding other factors that contribute to the nose dive).

This is why I continue to say that everything that is being done, i.e. aiding the financial institutions, defies logic. And every day they continue to defy logic the market and our economy will continue to be subject to deep sea diving. Think about it, simple or not, the banks should be taken out of the equation at this point. And if our elected officials are serious about rectifying the situation they need to start thinking outside of the box and outside of the normal monetary flow because after all we are living in abnormal times. Stop defying logic and get to the root of solving the problem which starts with the consumer and not the banks. And once this is rectified the economic wheels should begin to turn.

Lastly, job creation is good but what good is a job if the wage is lacking? And I wonder how many jobs can actually be created? Have we not just about exhausted all possible job generating industries? I keep hearing infrastructure but is there truly enough new infrastructure projects to keep us from going over the economic edge? And can these jobs be created expeditiously and in a timely fashion to help kick start the economy before a collapse? Just some logical questions I think are logically in order to be asked

No comments:

Post a Comment