It’s that time of the year and we are gleefully spending these hard earned dollars or maybe I should say we are swiftly borrowing to buy now and pay later via the credit cards we own. I like shopping but right now I would not dare use a credit card to make any kind of purchases if could not make a profit from those purchases and I would not dare take out any loans right now either. With our trade imbalance, we are a debtor nation. Let us go into detail about this debtor nation status of ours.

Ok this is how it works. We trade with China and others. To have a balance in trade, the amount of money that we spend in imports should equal the amount of money received in exports or there about. Problem. We hardly have anything to export. Oh we do export jobs though. Mea Culpa. I drifted but that is the first problem. We don’t have anything that we make that we can export anymore in exchange for receiving dollars, so that is contributor number one to our deficit problem in our current account. And because we are not receiving money through exporting or due to the lack thereof and the government’s spending due to the rumble in Iraq (I won’t call it a war because it’s not really) is outpacing the money that we receive, thus we have problem deux. They have cut taxes on behalf of those who most need to pay them, we are not getting any revenue from exports, so how are we getting money to spend you ask? Let’s look at our capital account, the flow of funds in and out of the country.

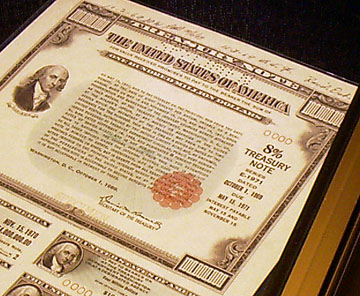

We sell bonds. We sell treasury bonds, corporate bonds mortgage backed bonds and foreigners and foreign central banks buy our bonds. These kind hearted people have mercy on the US and say ok you give us a bond with x interest and in z years we will earn a return on our purchase. We will pay you in us dollars for your bonds, which we received when you purchased our goods, so that you can have some money to spend. Oh how sweet of them. But it benefits them as well seeing that they do hold large sums of dollars it gives them the opportunity to invest those dollars. But here is where our debtor status comes in.

We sell bonds. We sell treasury bonds, corporate bonds mortgage backed bonds and foreigners and foreign central banks buy our bonds. These kind hearted people have mercy on the US and say ok you give us a bond with x interest and in z years we will earn a return on our purchase. We will pay you in us dollars for your bonds, which we received when you purchased our goods, so that you can have some money to spend. Oh how sweet of them. But it benefits them as well seeing that they do hold large sums of dollars it gives them the opportunity to invest those dollars. But here is where our debtor status comes in.Keep in mind, we hardly have any exports going out in order to receive revenue from them, those who should be paying taxes and bearing their fair share of the freedom load are getting tax breaks thus no revenue there, and add to that we are tallying up a huge bill for the rumble in Iraq with no incoming revenue to cover. Oh I forgot, BONDS. So when the President goes to congress and says “hey I need more funds for the rumble in Iraq” Congress says “we’ll do” and that tells our treasury department to start the presses. The bonds are auctioned and we get the proceeds. But this is where it gets interesting and leads us down the slippery slope of debt.

With all these dollars floating out and about it pressures our currency value downward. Meaning it becomes cheap for a foreigner to purchase a dollar and expensive for a US citizen to purchase other currencies. To put it another way our goods are cheap, their goods are expensive. Now let’s apply that to those bonds. When say China wants to get a return on their investment or they get mad at us and stop supporting our habit the amount we borrowed originally is not going to be the same amount that we owe because of currency depreciation (inflation.) It will probably cost us more to pay them back because our currency value will cause it to be more expensive for us to pay them if and when we have to pay up. Thus our debtor nation status. The general thought though is that China will continue to support our habit so that we will continue to buy their goods.

So you ask how does this affect Joe Blow me? As mentioned previously, goods become expensive when you are working with a devalued dollar. And if and when countries that hold our currency decide they want a return on their investment or they just don’t want to hold dollars any longer it will cause our currency to devalue. And other things happen too like with inflation comes higher interest rates, companies slowing down their investing because of these higher interest rates; high unemployment on the US side because companies are cutting back because of these higher interest rates which puts the squeeze on them and prevents them from doing too much investing in hiring; no one making any money, not able to pay bills, defaults and bankruptcies etc. because you can’t find a job or you have to accept a job making lower wages. You get the picture. All of this because we pledge allegiance to China via the us dollar and our uncontrollable spending and unwillingness to practice self constraint a.k.a. savings. So there you have it. If you are up to your neck in debt don’t feel bad. We are all in this thing, US Deficit, together. Happy Holidays!

I ran across this newsletter and they talk about the falling dollar among other things. It explains a further what I have written about.

No comments:

Post a Comment